YUGE if true

True…

I’m the sorcerer class

just now remembering that the way measurements work when translating metric to imperial it would be that the lowest inch that applies would count, not whatever it’s rounded to

Im lower class and evil

So get fucked, lol?

The mafia make the freaking kids gay

youre like eastern european your 2001 honda accord makes you royalty there

i love talking shit about eastern europe because scotland is inexplicably like if eastern europe and the nordics has a child

Audi A4 2004 actually so um owned

oh sorry bezos

hey wheres your dissertation on the history of the falcons or viking series i made you watch

Im not even eastern europe its the baltics but its such an irrelevant part of europe no one cares which is really funny

The long-ish version of the short version is that a bank determines how much your riskiness is, then determines how much a portfolio on the open market with the same riskiness would make. For the sake of example, let’s say that you’re 110% guaranteed to pay the money back no matter what, so if you’re getting a 30-year loan, the bank will look for the risk-free rate on a 30-year Treasury bond - which will always pay unless the government literally goes completely belly-up. This is currently 4.07%, but we’ll round to 4% for simplicity.

Now, second part. From the bank’s perspective, you paying $100 now is a lot less than you paying $100 twenty years in the future. Why? Because if you give them $100 now, they can invest it at that 4% rate. After 20 years, that $100 you paid today is worth $219 = $100 * (1.04) ^ 20, much more than the $100 you pay 20 years into the future. As such, the bank “discounts” future amounts, dividing it by 1.04 to the power of how many years in the future it is, then sums up all those amounts to get the Current Value. So if you pay $100 a year, the Current Value is $100 (this year) + $100/1.04 (next year) + $100/1.04^2 (year after)… + $100/1.04^30.

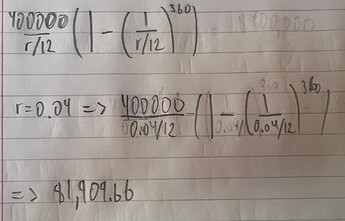

Final part: you make monthly payments for the next 30 years on a $500,000 house. Say that you pay 20% down payment, so you’re taking a loan for $400,000. The bank calculates the monthly payment so that the Current Value of the loan, discounted over 360 months at 1/12 the annual rate, equals $400,000. Using the formula for this, you get:

$1,909.66 is your monthly payment.

Across 360 payments, you’ll be paying $687,477.60.

Does this make sense?

lmao

i decided it was so good i had to write my phd thesis about it

gotta wait a bit due to the NDA though for me to release it to the public

fuckin dweeb lmao

barely