regardless we’re up 3% on the 1m on google and this is far from the biggest drop in recent months so like on the whole market seems fine

I’m selling based on multiple factors:

- I think there’s going to be a 2008-level or worse level crash

- I think there’s going to be a noticeable increase in inflation due to tariffs, trade wars, and consequence of saber rattling

I am not liquidating my retirement funds of which the vast majority of assets on the market are located. I’m liquidating stocks on my “higher yield savings account” fund.

Like for a variety of reasons I just want to be a touch more liquid.

sounds reasonable to me

Anyways, in brighter news, I’m gonna go see Flow.

The Flow of the river…?

(Is it a movie? What is it about?)

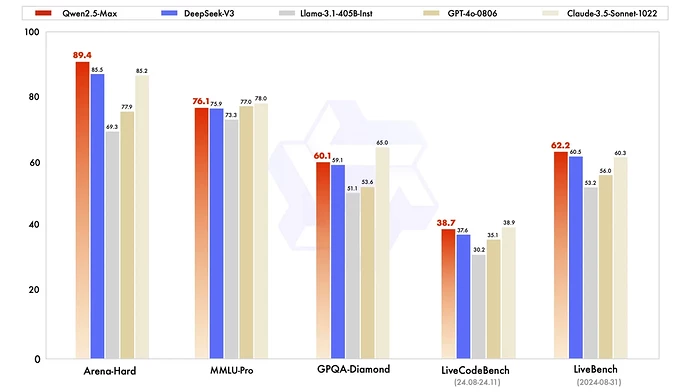

Another Chinese model that’s as good but perhaps better than ones produced in the west has hit the marketplace.

How do people truly know those AIs are better? What are the objective metrics?

there are benchmarks for these things

idk what they actually test but like companies are actively incentivized to come up with ways to test their product against others and show improvement so like ways to measure this do exist

just note that as per always industry-selected benchmarks are not a be-all-end-all measure of anything, lol

This is why openai tries to test chatgtp if they can pass things like the bar exam?

also go china

words I honestly didn’t expect to be saying but like hey ill take it

highkey this was inevitable lol - what else can they do when we restrict selling them powerful hardware except innovate in efficiency?

highkey this is probably even the good ending lol

My understanding is that it’s like Stray.

kind of, but that’s more of a marketing point than a real benchmark, since it’s a test designed to test humans, not one designed specifically to test LLMs

as a point of clarification I have approximately $0 in non-retirement funds that are in stocks, and I am 24 at this moment in time

for me just riding it out through the good and the bad is mathematically far and away the best strategy if historical trends continue, assuming I’m not able to see the future with enough granularity to dodge the exact timing of any potential market crash but stay in every day line go up

deffo think things change if we’re talking savings from somebody a fair bit older tho, I just don’t tend to assume most people have non-retirement money in the market because statistically most don’t, so im viewing this through the retirement savings lens first and foremost

I wish my economics class would make me understand those things so my mind isn’t up in the air trying to envision it

president xi my people yearn

Will this produce a sputnik crisis…

No, but all I care about is what the resulting perception will be.

i honestly hate the fact that the market rn is based on vibes moreso than actual value proposition